Roth 401k paycheck calculator

Contributions to a Traditional 401 k plan are made on a pre-tax basis resulting in a lower tax bill and higher take home pay. Ad Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing.

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

A 401k can be an effective retirement tool.

. This decision has tax implications which can be relevant to calculating. Contributions made to a Roth 401 k are made on an after-tax. One concern is whether your 401k or IRA is a Roth account or a traditional account.

Ad Strong Retirement Benefits Help You Attract Retain Talent. While your plan may not have a deferral percentage. Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

This is the percent of your gross income you put into a after tax retirement account such as a Roth 401k. When you make a pre-tax contribution to your. A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement.

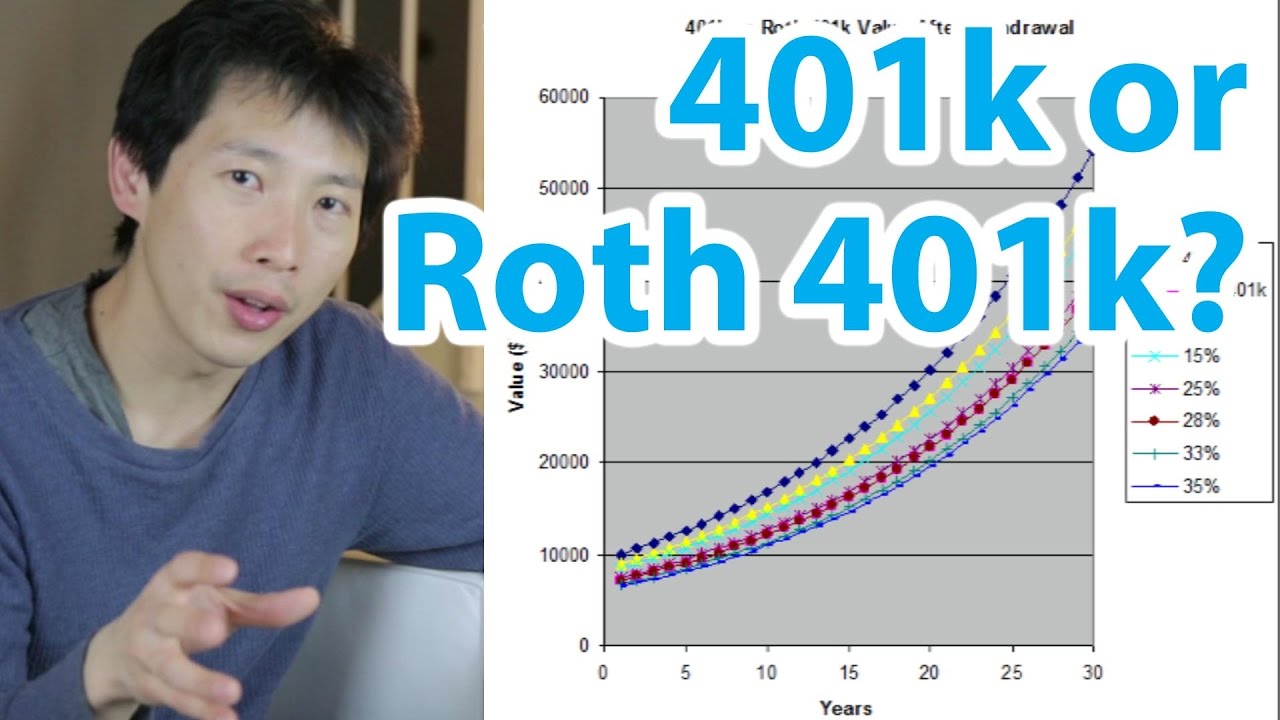

Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace. Traditional 401 k Roth 401 k 6031 6853 A Roth 401 k could provide additional income of 822 per year during retirement. This number is the gross pay per pay period.

NerdWallets 401 k retirement calculator estimates what your 401 k. Are for retirement accounts such as a 401k or 403b. For example say you are paid monthly your annual salary is 72000 and you elect to contribute 5 percent to your Roth 401 plan.

It is mainly intended for use by US. This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. The hypothetical annual effective rate of return for your 401 k account.

Reviews Trusted by Over 20000000. For annual pay frequencies it. Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Official Site - Open A Merrill Edge Self-Directed Investing Account Today.

For the traditional 401 k this is the sum of two parts. So if you elect to save. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Open a Roth IRA Account. Retirement Calculators and tools. Compare 2022s Best Gold IRAs from Top Providers.

Roth IRA Based on age an income of and current savings of You will need about 6650 month in retirement Your IRA will contribute 2781 month in retirement at your current savings rate. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. For calculations or more.

Ad Dont Pay Taxes When You Withdraw Your Money After You Retire. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Traditional 401k and your Paycheck.

Second multiply your gross income per pay period by the. Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

For some investors this could prove. Roth 401k plan withholding. For the Roth 401 k this is the total value of the account.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. As of January 2006 there is a new type of 401k contribution. Before retirement inputs Years until retirement 20 years.

This calculator assumes that your deposits are made at the beginning of each pay period. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. The Sooner You Invest the More Opportunity Your Money Has To Grow.

First divide your annual salary by the number of pay periods per year to calculate your gross income per pay period. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Divide 72000 by 12 to find your monthly gross.

Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. Subtract any deductions and. 1 The value of the account after you pay income taxes on all earnings and.

Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. Back to All Calculators.

The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn.

401 K Calculator See What You Ll Have Saved Dqydj

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth 401k Might Make You Richer Millennial Money

401k Calculator Paycheck Outlet 50 Off Www Ingeniovirtual Com

Traditional Vs Roth Ira Calculator

How Valuable Is The New Roth 401k Option 401khelpcenter Com

Toast Payroll 401 K Roth Simple Ira Employer Match Troubleshooting

Solved After Tax Roth 401 K Employee Deductions Company Contributions

The Ultimate Roth 401 K Guide District Capital Management

Roth 401k Roth Vs Traditional 401k Fidelity

401 K Vs Roth 401 K Calculator Which One Should You Invest In The Kickass Entrepreneur

How To Calculate Roth 401 K Withholding

Traditional 401 K Vs Roth 401 K Ubiquity

Understanding The Mega Backdoor Roth Ira

401k Calculator Paycheck Online 59 Off Www Ingeniovirtual Com

Traditional Vs Roth Ira Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator